Objectway Platform

Digital Wealth Ecosystem by Key Pillars, Solutions, and Services

Self-Service & Hybrid Digital Channel

Automated tools for independent financial management with personalized guidance through digital platforms, optimizing client interaction and enhancing financial decision-making capabilities

- Digital Client Onboarding

- Portal & Apps

- Digital Asset Management

Analytical tools, client management interfaces, financial planning and real-time data access, enabling advisors and bankers to offer tailored financial guidance efficiently

- Advisor Desktop

- Client Lifecycle Management

- Financial Planning

Professional guidance and support to help clients to make well-informed decisions and achieve their goals, navigating complex financial or strategic matters

- Investment Advice

- Portfolio Management

- Risk, ESG & Compliance

Self-Service & Hybrid Digital Channel

Digital Client Onboarding

Adopt an automated & omni-channel onboarding strategy to improve client experience and enhance business productivity in compliance with regulatory requirements

Key Features

- Prospect Registration

- KYC & Questionnaire

- Account Opening

- E-Signature

Portal & Apps

Create an omni-channel and optimised digital banking and investment experience for your customers, enabling digital collaboration.

Key Features

- Prospecting

- Communication & Reporting

- Digital Collaboration

- Mobile Apps

Digital Asset Management

Leverage the innovative digital wealth platform that helps you transform your business by better managing your time, revenue, client relationships, and access to discretionary portfolio managers.

Key Features

- Seamless Book Transfer

- Customized ETF and Fund Portfolios

- Portfolio Rebalancing

- Dedicated Support

Key Market Segments

Advisor / Banker Workstation

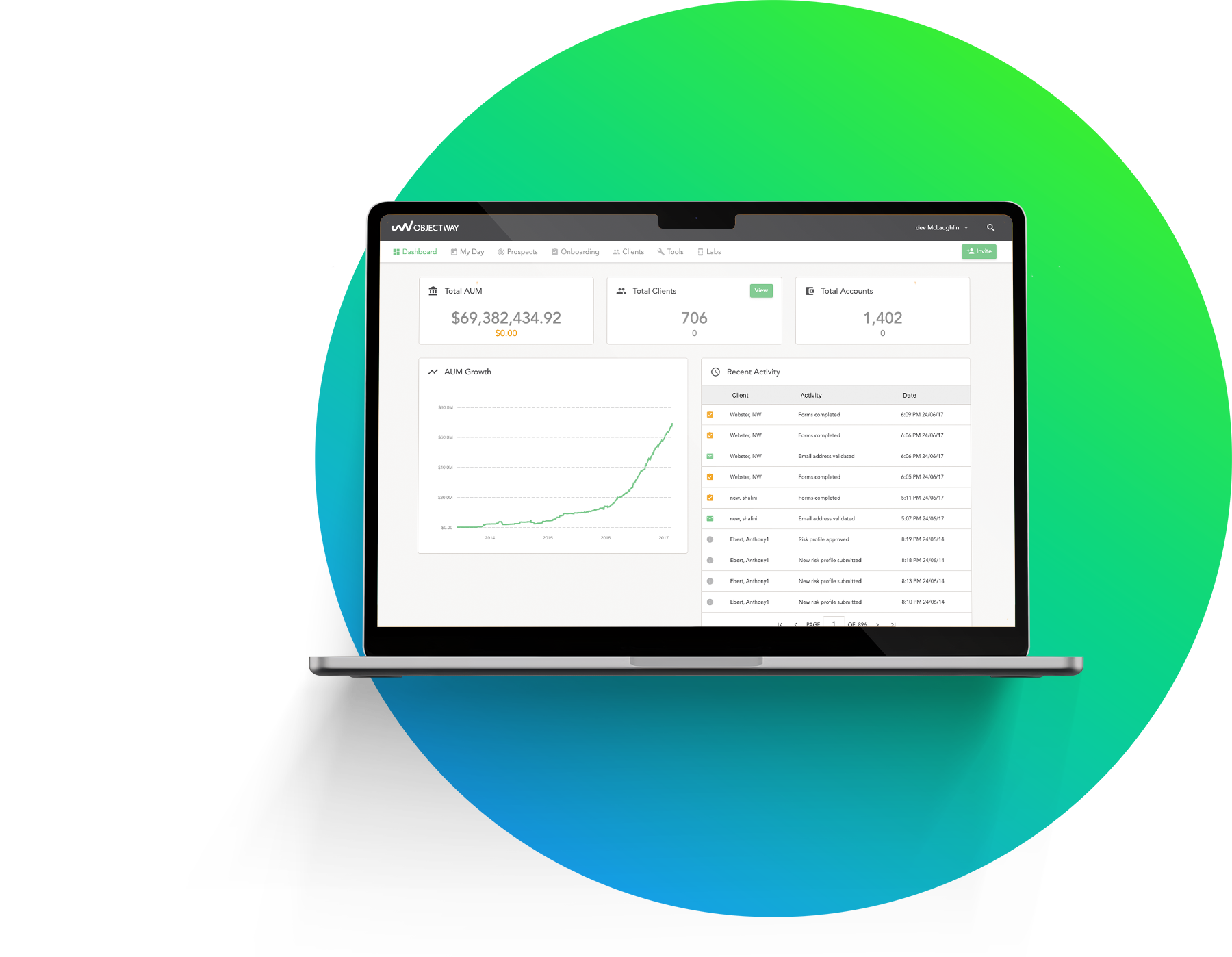

Advisor Desktop

Boost advisor productivity introducing business to the firm with a 360° client view and a new experience platform that automates information delivery, providing actionable insights.

Key Features

- My Business

- Client & Portfolio View

- Digital Collaboration

- Client Risk Profiling

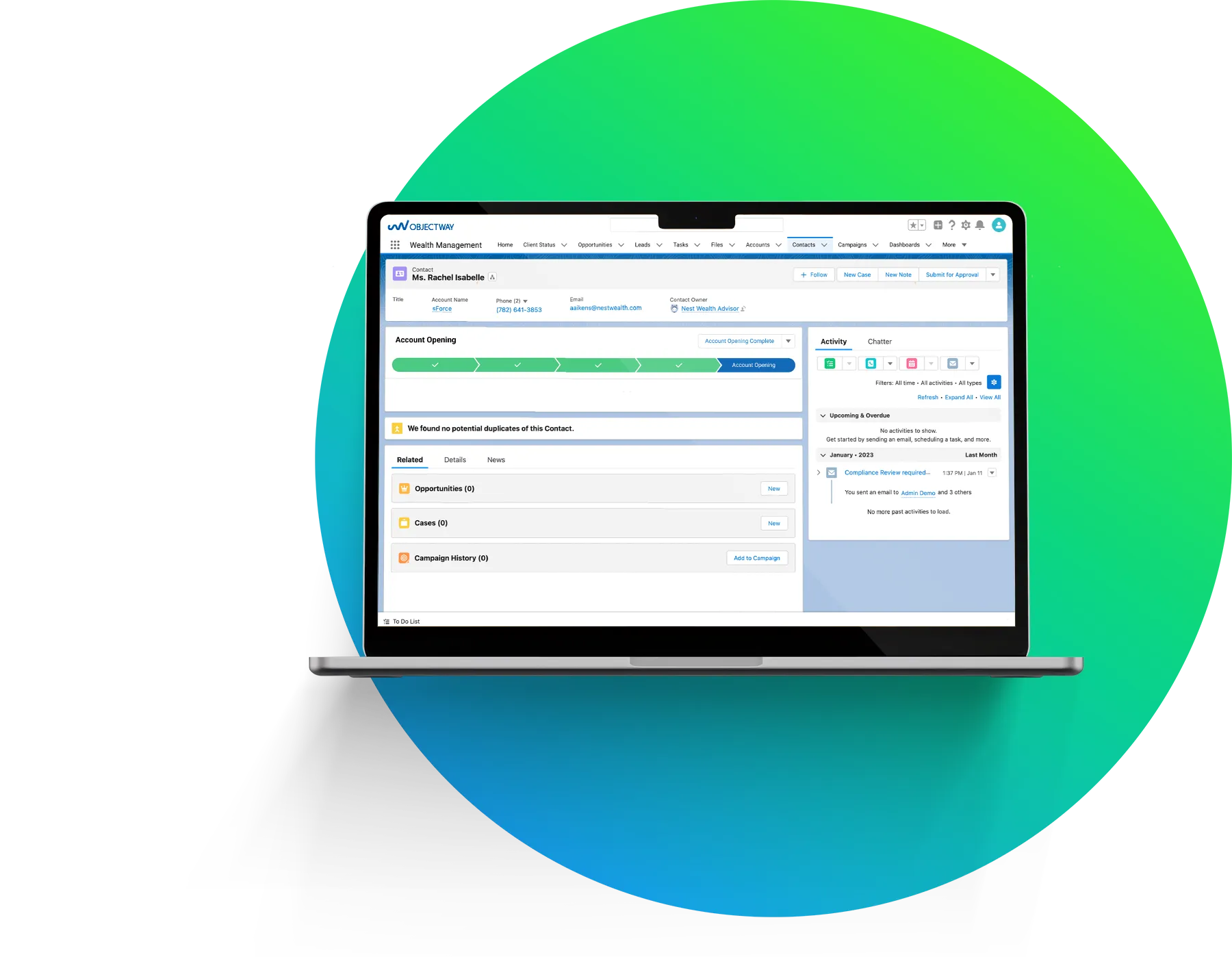

Client Lifecycle Management

Be more effective in your day-to-day tasks, better serve your clients and increase revenues with a smart client management solution.

Key Features

- Wealth Manager CRM

- Suitability Assessment

- Reporting to Client

- Contract Management

Financial Planning

The Financial Planning Solution that takes minimal time to complete and focuses on engaging clients through meaningful discussions and needs analysis.

Key Features

- Retirement Planning

- Insurance Needs Analysis

- Professional Reporting & Visualizations

- Decumulation Optimizer

- Proper Tax Calculations

Visit RazorPlan

Razorplan is aligned with Canadian regulations and standards. For clients outside Canada, custom financial planning solutions may be developed upon request to ensure alignment with local regulations and standards.

Investment Service Management

Investment Advice

Augmented intelligence empowering human expertise to deliver personalised investment proposals, bringing client relationship to center stage.

Key Features

- Goal Based Advisory

- Client Portfolio Optimization

- Client Risk Profiling

- Client Reporting

- Advisor Analytics

Portfolio Management

Deliver performance through a holistic closed-loop portfolio management process and a perfect investment strategy execution.

Key Features

- Portfolio Analysis

- Portfolio Modelling & Rebalancing

- Performance Management

- What-if Simulations

- Order Management

- Investment Compliance

Risk, ESG & Compliance

Assess and clearly document customer’s risk profile and investment rationale using a real-time engine which provides actionable insight and historical information management.

Key Features

- Compliance Assessment

- Performance Analysis & Attribution

- Risk Analytics & Data Quality

- Model Portfolio Construction

Self-Service & Hybrid Digital Channel

Digital Client Onboarding

Adopt an automated & omni-channel onboarding strategy to improve client experience and enhance business productivity in compliance with regulatory requirements.

Key Features

- Prospect Registration

- KYC & Questionnaire

- Account Opening

- E-Signature

Portal & Apps

Create an omni-channel and optimised digital banking and investment experience for your customers, enabling digital collaboration.

Key Features

- Prospecting

- Communication & Reporting

- Digital Collaboration

- Mobile Apps

Digital Asset Management

Leverage the innovative digital wealth platform that helps you transform your business by better managing your time, revenue, client relationships, and access to discretionary portfolio managers.

Key Features

- Seamless Book Transfer

- Customized ETF and Fund Portfolios

- Portfolio Rebalancing

- Dedicated Support

Key Market Segments

Advisor / Banker Workstation

Advisor Desktop

Boost advisor productivity introducing business to the firm with a 360° client view and a new experience platform that automates information delivery, providing actionable insights.

Key Features

- My Business

- Client & Portfolio View

- Digital Collaboration

- Client Risk Profiling

Client Lifecycle Management

Be more effective in your day-to-day tasks, better serve your clients and increase revenues with a smart client management solution.

Key Features

- Wealth Manager CRM

- Suitability Assessment

- Reporting to Client

- Contract Management

Financial Planning

The Financial Planning Solution that takes minimal time to complete and focuses on engaging clients through meaningful discussions and needs analysis.

Key Features

- Retirement Planning

- Insurance Needs Analysis

- Professional Reporting & Visualizations

- Decumulation Optimizer

- Proper Tax Calculations

Visit RazorPlan

Razorplan is aligned with Canadian regulations and standards. For clients outside Canada, custom financial planning solutions may be developed upon request to ensure alignment with local regulations and standards.

Investment Service Management

Investment Advice

Augmented intelligence empowering human expertise to deliver personalised investment proposals, bringing client relationship to center stage.

Key Features

- Goal Based Advisory

- Client Portfolio Optimization

- Client Risk Profiling

- Client Reporting

- Advisor Analytics

Portfolio Management

Deliver performance through a holistic closed-loop portfolio management process and a perfect investment strategy execution.

Key Features

- Portfolio Analysis

- Portfolio Modelling & Rebalancing

- Performance Management

- What-if Simulations

- Order Management

- Investment Compliance

Risk ESG and Compliance

Assess and clearly document customer’s risk profile and investment rationale using a real-time engine which provides actionable insight and historical information management.

Key Features

- Compliance Assessment

- Performance Analysis & Attribution

- Risk Analytics & Data Quality

- Model Portfolio Construction

Need specific information?

Don’t hesitate to reach out to us

We’re here to help and provide the answers you’re looking for about our Digital Wealth Platform