Best-in-class services and operating models, based on a holistic closed-loop portfolio management process and a perfect investment strategy execution.

The Ultimate Portfolio Management Solution

The Ultimate Portfolio Management Solution

Portfolio Analysis

Portfolio Analysis

Go exception based with our pro-active dashboard which monitor each angle of portfolios and individual holdings. Analyze exception and take adequate action to resolve or defer inefficiencies in the portfolio.

Stay in control of key metrics on the portfolio, risk, cost and suitability. Also being able to:

- Track income yield

- Track diversification

- Track agreed preferences

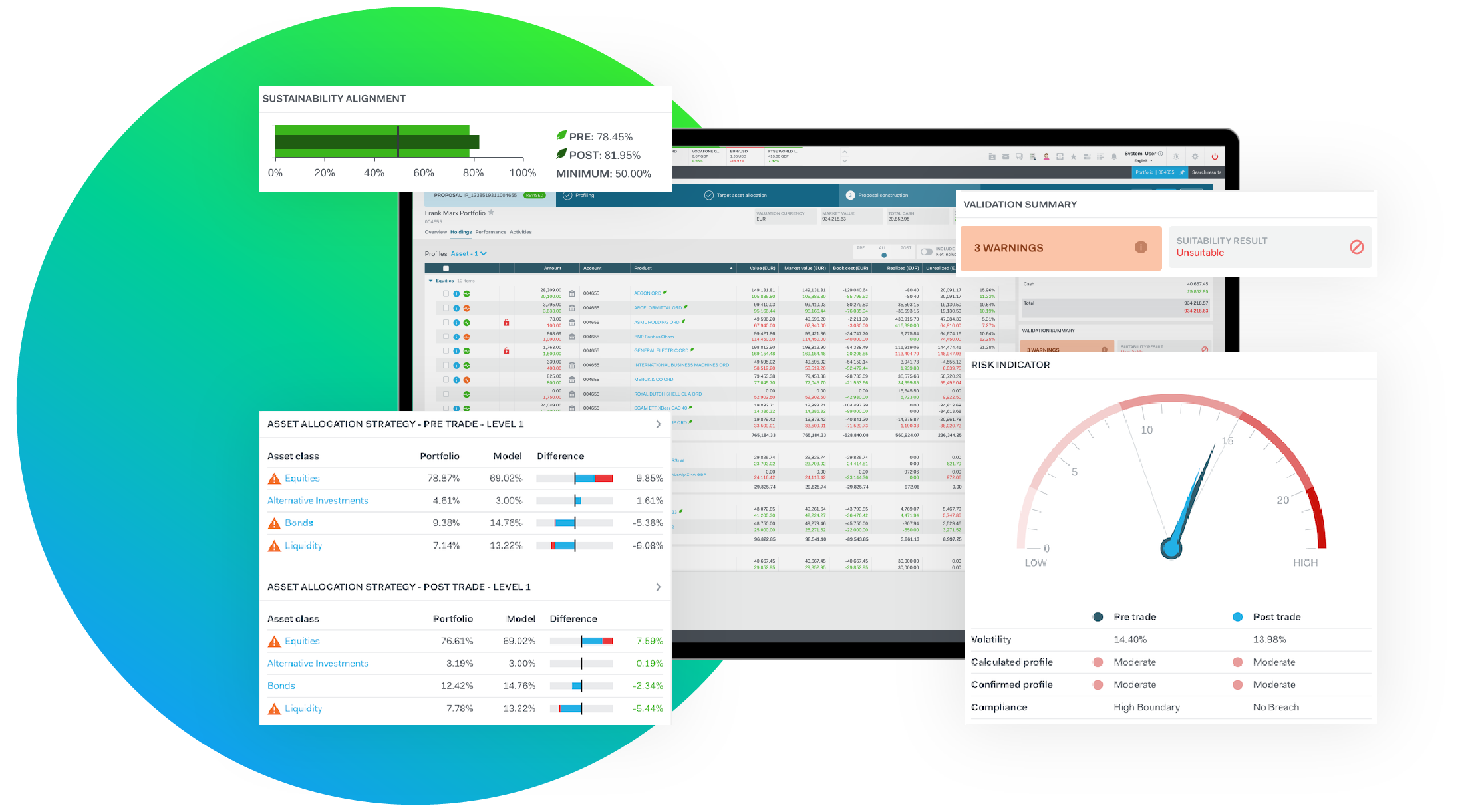

Portfolio Allocation & Rebalancing

Portfolio Allocation & Rebalancing

Manage investment on account or family level. Define strategic and or tactical allocations and be alerted when categories deviate outside thresholds. Rebalance the portfolio back to targets. Use mass rebalancing for large group of clients and of portfolios.

- Full or partial calculations

- Include cost impacts

- Include compliance impacts

- Including placed orders

Performance Measurement

Performance Measurement

Show your clients different performance metrics, based on several GIPS compliant methodologies. Dive deeper into contributions and attribution where required. Use performance data to offset the risk taken to achieve the returns. Relative and absolute risk measures are one click away for the user.

- Absolute and Relative Risk

- Sharp ratio, volatility

- VAR, Tracking error

Order Management

Order Management

Create and Route orders within two clicks. You can either generate single or block orders on any instrument type including FX. Suitability assessment done automatically. Managing order routing to brokers and execution platforms via dealing capabilities.

- Route to brokers

- Pre-trade compliance

- Regulatory reports

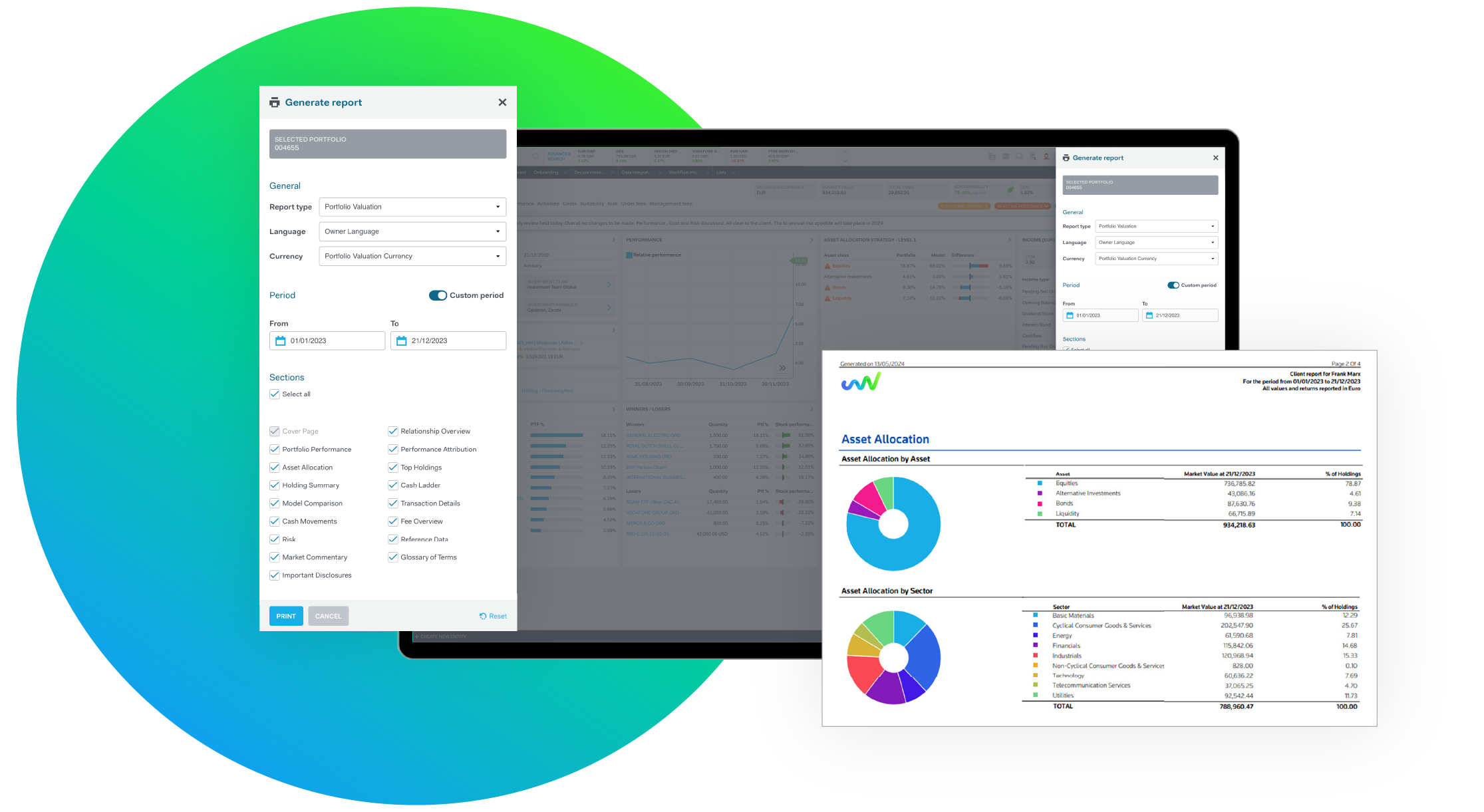

Client Reporting

Client Reporting

Delivering result to clients via client reporting is a regulatory item which can be easily done via the platform. Tailored reports, customizable pages and content are available for generation and distribution.

- Compliant client reports

- Branded and themed

- Publish to DMS or Portal

Optimize Your Business Processes to Unlock Investment Potential

- Portfolio Management is the Front Office component of the Objectway Platform

- Connected to multiple market data vendors, multiple custodians and multiple other data sources

- Link the Objectway Portal or your own portal to it

- Financial Planning is integrated via Objectway Razor Plan

Unleash Your Digital Potential

Proactive management of investment via smart and efficient desktop, to meet clients’ financial goals and build long-lasting, trust-based relationships.

Staying in control of portfolios is critical for driving better client outcomes. It enables proactive management, informed decision-making, customized strategies, enhanced communication, effective risk management, performance optimization, and ensures compliance.