JANUARY 18, 2017

Digital Engagement and Collaboration in Wealth Management – II part

Product Marketing Leader

Reading time: 2 min

OWINTALK | BEHIND BUSINESS, BEYOND NEWS

As I said one week ago, we conducted the new edition of the Objectway-Efma survey “Digital engagement and collaboration in wealth management: the hype, the reality and the future”.

Here’s the second; you can read the beginning and the third one.

The study results

Today, I’m proud of letting you know the others relevant results of our survey.

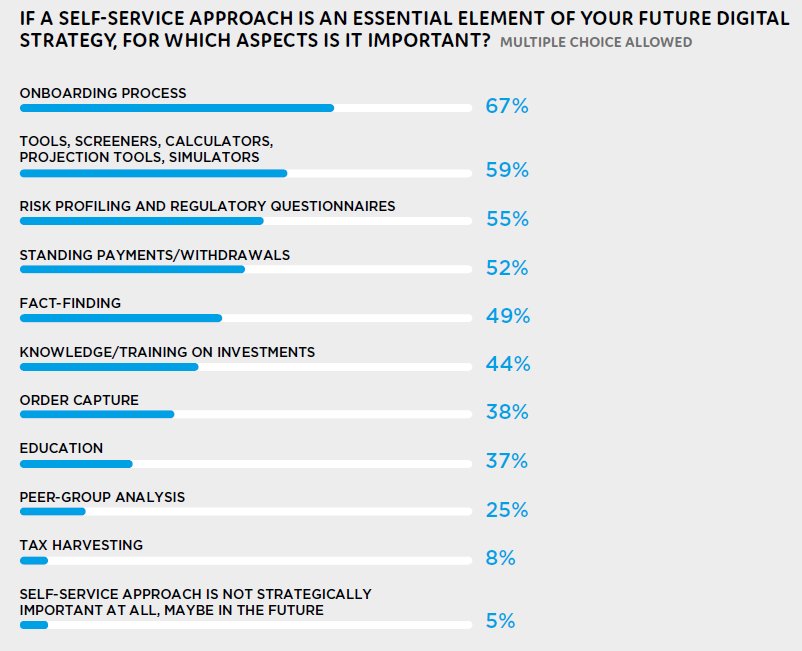

The relevant aspect that wealth and investment firms will have to deal with is the growing demand for a self-service approach to investments from digital investors. The survey results show that it can be exploited for several purposes (tools and simulators, risk profiling, regulatory questionnaires), but especially for the client onboarding process (67%).

Redefining this process is a challenge for many organisations, since they have to keep consistency, efficiency and compliance across any step and at any point of contact. Once the data collection is conducted directly by the client, relying on a self-service approach could improve efficiency, do management by exceptions and save time for added-value advisory activity.

In our survey emerged also that when it comes to customised services, analytics and social media are the most appropriate tools to achieve a deep knowledge of the investor. Some time ago financial institutions were using analytics mainly to capture static data. Nowadays and in the next future, it will be used to better understand the client and to extract relevant life events from the huge amount of clients’ behavioral information, in order to address the most appropriate proposal.

So far, nearly half of institutions used social media, but often without integration into the investment value chain. Analyzing the publically available knowledge about clients to frame and interact with each client will become more mainstream over the coming years.

Moreover thematic virtual communities providing the ability to clients to interact with other investor members can represent a further opportunity to position the organization favorably and to differentiate from the competition.