Reading time: 5 min

OWINTALK | BEHIND BUSINESS, BEYOND NEWS

On June 10th, Deputy Prime Minister and Finance Minister Chrystia Freeland presented her much-anticipated capital gains proposal to Parliament, setting the stage for a pivotal vote that could have far-reaching consequences for entrepreneurs across the country. Discover who stands to gain and who might lose out under this new proposal.

The Canadian Entrepreneur’s Incentive (CEI) aims to reduce taxes on up to $6.25 million of capital gains—but conditions apply, and most Canadian business owners will end up paying more!

The budget notes that entrepreneurs with eligible capital gains of up to $6.25 million will benefit under the proposed Capital Gains Tax changes. Consider the example of Kate, an entrepreneur who founded a fintech startup years ago. If she sells her company to a larger fintech firm, earning $2 million in capital gains, Kate would only pay tax on $667,000 (33% of the $2 million in capital gains) when the CEI is fully implemented. This represents a reduction in her taxable income by $333,000 compared to the current 50% capital gains inclusion rate.

Furthermore, when the CEI is fully implemented, along with the increased Lifetime Capital Gains Exemption (LCGE) of $1.25 million, entrepreneurs like Kate will benefit from at least $3.25 million in total and partial lifetime capital gains exemptions. This means some entrepreneurs will pay less tax on up to $6.5 million of capital gains.

To illustrate, let’s consider a hypothetical scenario that examines how the proposed changes to capital gains would impact Kate if she fails to meet one of the conditions.

What is the Canadian Entrepreneur’s Incentive (CEI)?

To clarify, I consulted the Canada Copilot AI, a free tool powered by artificial intelligence trained on the 2024 Canadian Federal Budget. Here’s the explanation it provided:

Reduced Inclusion Rate on Capital Gains:

- The inclusion rate on eligible capital gains will be reduced to 33.3%

- This applies to a lifetime maximum of $2 million in eligible capital gains.

Increased Lifetime Capital Gains Exemption:

- When fully implemented, the incentive will provide entrepreneurs with a combined exemption of at least $3.25 million when selling all or part of their business.

- This includes the increased total lifetime capital gains exemption of $1.25 million.

- The $2 million additional incentive will increase by $200,000 each year, starting in 2025, until it reaches $2 million in 2034.

Eligibility Criteria:

The $2 million additional incentive will be available to founding investors who:

- Own at least 10% of the shares in their business.

- Have had the business as their principal employment for at least 5 years.

- The business must be in certain eligible sectors.

In summary, the Canadian Entrepreneurs’ Incentive aims to provide significant tax relief to entrepreneurs when they sell their businesses, in order to encourage entrepreneurship and business growth in Canada. Eligible entrepreneurs can benefit from up to $3.25 million in total and partial lifetime capital gains exemptions.

How Much Tax Will Kate Have to Pay?

In my hypothetical scenario, I assumed Kate’s business is located in Ontario and has a Fair Market Value (FMV) of $6,500,000. She has never claimed any LCGE and is the only shareholder. To simplify the analysis, I did not consider inflation or growth on the FMV of the business.

For calculations, I used the RazorPlan Financial Planning Software, which provides advanced tax settings to illustrate pre & post-2024 Budget proposals, along with various Corporate Estate Planning strategies such as Stop-loss and Pipeline planning.

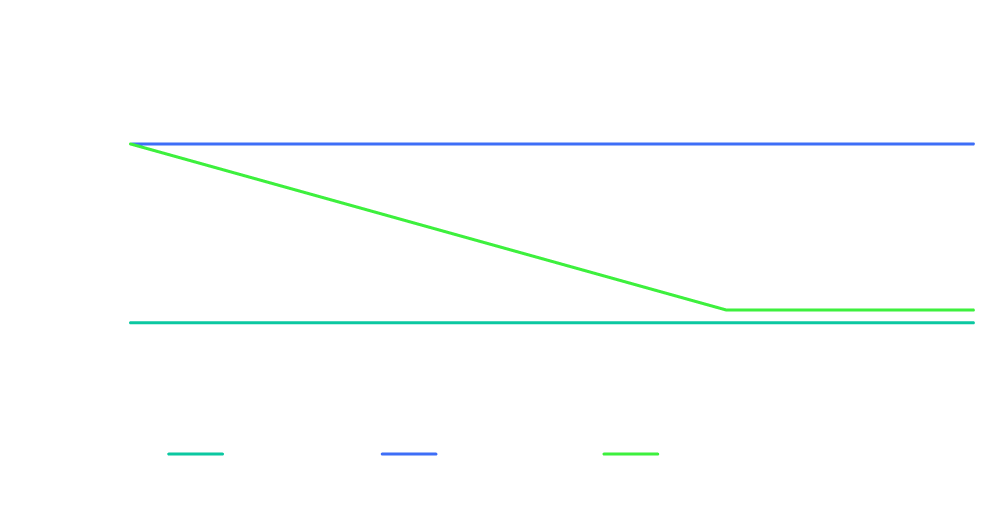

The illustration below compares Kate’s capital gains tax under the old and new rules, assuming she qualifies for the CEI. Once the CEI is fully implemented in 2034, her capital gains tax will be $1,495,000 compared to $1,468,000 under the old rules.

However, if Kate’s business is not in “certain eligible sectors” or if she fails to meet other “eligibility criteria,” her capital gains tax under the proposed rules will increase to $1,851,000—an increase of $383,000 or 5.9%.

How do the Changes Impact Holding Companies?

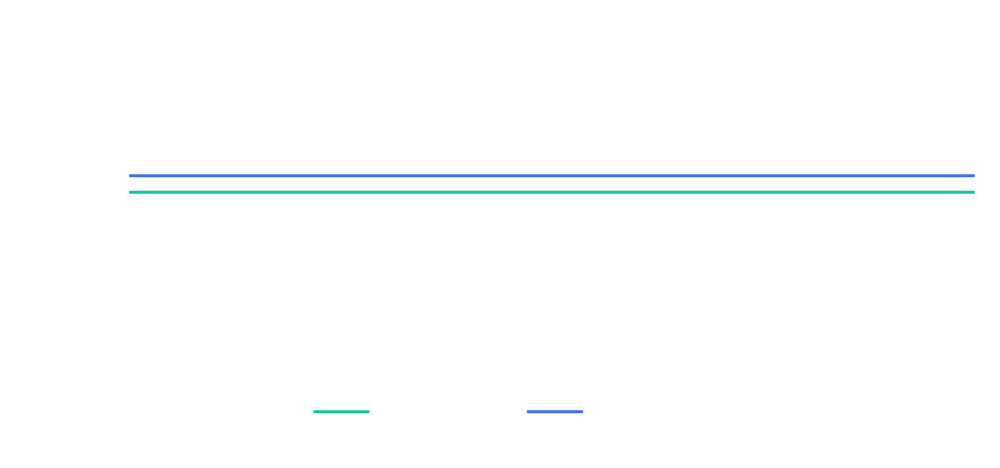

Most Canadian entrepreneurs I have worked with are focused on creating a business that earns a profit, which the owner can then invest for their future. What if Kate’s business is a holding company with a $6.5 million investment portfolio that has an ACB of $4,500,000? To avoid double taxation, her estate plan includes winding up her corporation to take advantage of the Stop-Loss rules. In this scenario, the total tax payable would be $2,920,000 compared to $2,728,000 under the old rules. The increase of $193,000 in tax payable is the result of the proposed changes to the capital gains inclusion rate from 50% to 66.67% for corporations, impacting the tax paid and the RDTOH available on wind-up.

In conclusion, the Canadian Entrepreneur’s Incentive (CEI) introduces notable changes to the tax landscape for entrepreneurs in Canada, promising significant reductions in capital gains tax for those who meet specific criteria. However, eligibility restrictions and sector-specific conditions suggest that not all business owners will benefit equally. Understanding these nuances is crucial, especially for those planning significant business transactions in the near future.

For a more personalized analysis of how these changes might affect your client’s financial strategy, consider exploring RazorPlan Financial Planning Software. This tool offers detailed insights and simulations tailored to the latest tax regulations. Additionally, for a broader understanding of the 2024 Canadian Federal Budget and its implications on entrepreneurial clients, take advantage of the free Canada Copilot AI tool provided by EVAD.AI. Both resources can enhance your planning and decision-making process.

Visit their websites today to learn more and ensure that your financial planning advice is as effective and informed as possible.

This content was created with assistance from artificial intelligence. The information provided should be used for informational purposes only and is not intended to be financial or investment advice. Please consult with a qualified financial advisor before making any financial decisions.