JULY 13, 2020

Digital Wealth Management: Artificial Intelligence to Accelerate Value Creation

Innovation Director

Reading time: 2 min

OWINTALK | BEHIND BUSINESS, BEYOND NEWS

We talked about how digitalisation can bring a first level of benefits in Wealth & Investment Management: cost reduction, customisation and automation.

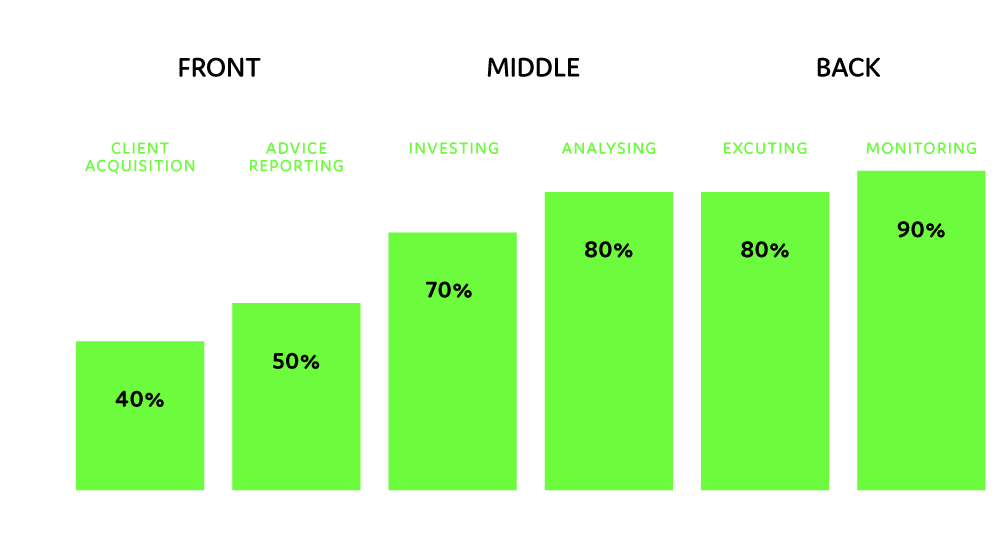

The second level of advantages is connected to the introduction of artificial intelligence according to the contribution of the human element, as shown in the figure below.

Areas of applicaton of AI in Wealth Management

Source: LGT Vestra, 2018

Let’s see how artificial intelligence can make the difference in each area, maintaining the distinction between Front Office, Middle Office and Back Office presented in the previous article.

Artificial intelligence at work in Wealth Management

Some activities that artificial intelligence can support in the Front Office are the following:

- Customer profiling: technologies such as Natural Language Processing accelerate and facilitate the collection of information normally acquired by communicating with the customer. They are able, for example, to transcribe a speech and search for key concepts in it.

- Consulting: knowledge-based models help to profile risk, support the advisor, take into account all the customer’s needs, especially those that classical interaction does not identify, but that AI can obtain and connect among the collected information.

- Reporting: often considered inadequate or too complex, it carries the risk of being an excessively standardised and mass-produced communication, regardless of each customer’s preferences. If the client is profiled with artificial intelligence tools, he can receive personalised and specific information related to his interests and objectives.

- Planning: financial advisors need to optimise their time according to customer interactions. Artificial intelligence can support them by collecting reports, information and documents useful for each customer.

In the Middle Office, investment analysis and decision-making processes could benefit from the use of artificial intelligence in various ways:

- Risk management: AI makes it possible to use algorithms to build predictive scenarios to support the investment process.

- Investments selection: Machine Learning algorithms can support the creation of highly customised portfolios considering market variables and the specificity of investment instruments, even if applied to large groups of clients (Mass Customisation).

The Back Office could apply artificial intelligence to the execution and supervision of investment processes in the following way:

- Operations: taking into account the general objective of maximum automation and minimum human intervention, Machine Learning can analyse flows and volumes performing predictive analyses in real-time, in order to maintain optimal performance and anticipate any problems.

- Compliance: Machine Learning can help to automatically identify the most likely problems that may occur, increasing staff productivity and providing actions and feedback that become part of machine’s knowledge.

We must remember that artificial intelligence is not the answer to everything, nor the exclusion of the human factor in Wealth Management activities. There are constraints and precautions that distinguish successful management from one that is struggling to follow market developments and we will talk about it soon.